The AI bubble debate comes up regularly in conversation. I usually avoid the topic because the answer is never clean. Valuations are stretched in places, infrastructure spend is massive, and parts of the market are already pricing in a future that hasn't fully arrived. Yet AI remains one of the most important technological shifts of our lifetime. Both things can be true. We can be early and still overpriced in pockets at the same time.

Azeem Azhar articulated the real distinction well a few months ago (still the best write-up on the matter: his five-part framework weighing genAI against history's bubbles). The difference between a boom and a bubble isn't just semantic. A boom is when fundamentals eventually catch up to the optimism. A bubble is when valuations drift materially away from underlying prospects and never recover. Investment outpaces real usage, and realised productivity in the form of returns never arrives to justify the bet.

Today hype pays for infrastructure whereas tomorrow adoption must pay it back. Right now most enterprise adoption is still surface level. Teams are prompting. They are not yet running multi-step agents, deep workflow automation or replacing full units of labour. When reasoning systems, memory and orchestration layer solutions land at scale, inference demand will curve upward hard. But we are not there yet. And timing is everything.

As Azeem puts it, we're in the eye of the storm. You can feel the wind, rain and pressure, but you don't yet know whether it will clear the air or flatten the house. Bubbles are impossible to diagnose in real time. Only in retrospect do we know whether exuberance was justified or delusional.

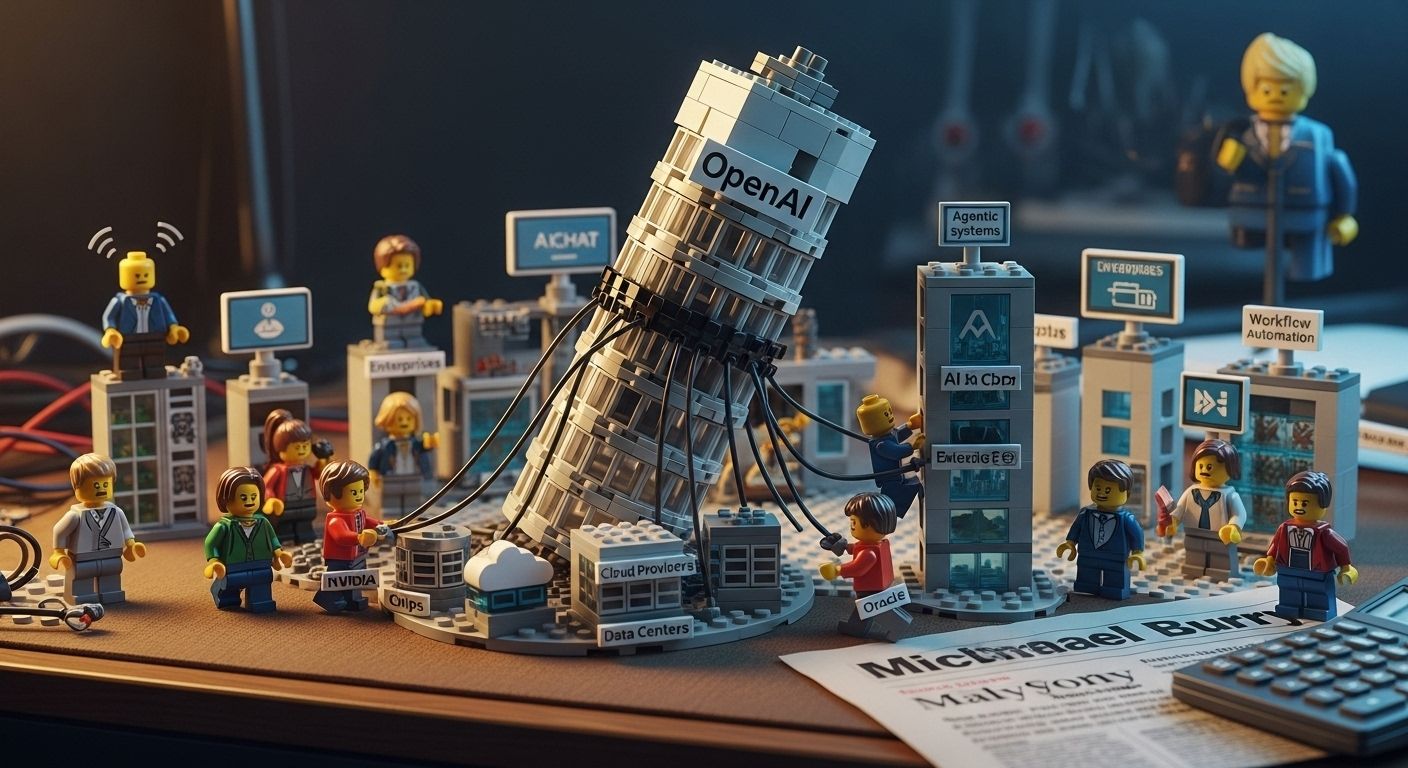

This is where concentration becomes uncomfortable. So much capital is anchored to a single node: OpenAI.

Nvidia committing up to USD 100B into OpenAI.

Oracle preparing multi-hundred-billion compute capacity for OpenAI.

Project Stargate includes OpenAI and is sized at roughly USD 500B in future infrastructure.

When that volume of investment sits on one pillar, the upside compounds, but the downside is systemic. If OpenAI underdelivers on revenue or inference consumption even briefly, the impact will not stay contained. Chips, cloud providers, data centres, training pipelines, model companies, and the entire application layer will absorb the shock. Nothing bursts cleanly, it avalanches.

We will also see Nvidia pull back at some point. It has to. The run has been extraordinary. When it does, many will call it the crash. But alternatives for compute are emerging. Google TPUs have now been proven at scale under Gemini 3, which shifts pricing power and availability. A dip may not signify collapse; it could simply be redistribution rather than implosion.

Jensen Huang reinforces this from another angle in his interview of the BG2 podcast. He believes inference has barely begun, and that as AI shifts from simple chats to agents that execute processes end-to-end, demand will multiply. Naturally his position benefits from that belief, but the logic holds. If AI evolves from generating text to coordinating operations, engineering, sales, logistics, and analysis, the compute base today could look small in hindsight. And if that is the future, the current infrastructure build will be foundational rather than wasteful.

Michael Burry is circling as well. He called the 2007 crash when almost nobody wanted to hear it. If he's right (he's been right fifteen times before, hasn't he?) timing will flip the narrative and we'll feel it in markets, capital flow and confidence. If he's wrong, those who keep building instead of trading sentiment will come out ahead. Even in bubbles, the builders win as long as they make disciplined decisions because the technology remains after the money resets.

So are we in a bubble? Maybe. Will it matter if one part of the stack deflates? Yes, because it's all connected. Could the correction be soon or years away? Both are believable. The only thing we know for sure is volatility.

Which is exactly why the bubble debate doesn’t keep me up at night.

Not because it's unimportant, but because the question is unanswerable and the answer changes nothing about what we should be doing. There are three reasons the bubble debate doesn't land for me.

First, we're not playing the same game as the people asking the question.

Traders care about timing. Investors care about valuations. Builders care about whether something works. Commerce businesses aren't investing in Nvidia stock or building data centres. They're deciding whether to automate email workflows, build agent-assisted customer service, or let AI handle product categorisation. Those decisions don't hinge on market timing. They hinge on whether the ROI is there today. Can this solve a problem I have right now, and will it still work if the hype deflates? If yes, build. If no, wait. The bubble debate is for people trading sentiment, not solving problems.

Second, even if we're overbuilt, infrastructure doesn't disappear.

Every technology boom overspends early, then spends years growing into the capacity. The dotcom crash didn't erase the fibre. The cloud boom didn't waste the data centres. In the 1990s, telecoms laid 70 million miles of excess fibre that sat dark underground. It looked like waste. But that infrastructure eventually got lit up as demand caught up. The same pattern has repeated across railways, electricity grids, and cloud computing.

If we've overbuilt on compute right now, the infrastructure will still be there when enterprise workloads scale to meet it. Since ChatGPT's release in late 2022, hyperscalers have more than doubled their annual data centre capex. That's an enormous bet. But the question is just timing, and timing only matters if you're trying to trade the moment rather than build the capability. Whether agentic systems arrive in 2026 or 2028 doesn't change whether you should be learning now. The compute will be cheaper and more accessible by the time you need it at scale, bubble or not.

Third, the technology already works.

Right now. Today. AI is reshaping how we write, how we code, how we analyse data, how we communicate with customers. Whether OpenAI is overvalued or Nvidia pulls back doesn't change the fact that we can build things today that were impossible eighteen months ago. If the market corrects, the capability doesn't disappear. It just gets cheaper and more accessible. The real question isn't whether we're in a bubble. It's whether we're creating enough value that we'd still be doing this work even if the hype disappeared tomorrow.

If the answer's yes, carry on. The bubble can do what it wants. If you wait for the market to settle before you start learning, you'll be two years behind when it does.

Written by Mike ✌

Passionate about all things AI, emerging tech and start-ups, Mike is the Founder of The AI Corner.

Subscribe to The AI Corner